Welcome to our Financial Journey Dividend Income Update. We started the journey to Financial Independence in 2019 and paid off $60,000 in consumer debt. We got excited, and since July 2020, we’ve been tracking and sharing our journey to Financial Independence. Let’s take a look and see the dividend income received in February 2021.

Journey to Financial Independence – Dividends breakdown

In February 2021, we have received dividends from the following companies:

| Ticker | Name | $ |

|---|---|---|

| XEI.TO | iShares S&P/TSX Composite High Dividend Index ETF | 0.83 |

| REI-UN.TO | RioCan Real Estate Investment Trust | 19.04 |

| VRE.TO | Vanguard FTSE Canadian Capped REIT Index ETF | 2.37 |

| TD.TO | Toronto-Dominion Bank | 553.00 |

| RY.TO | Royal Bank of Canada | 227.88 |

| BMO.TO | Bank of Montreal | 286.20 |

| EMA.TO | Emera Inc | 241.61 |

| T | AT&T Inc. | 134.16 |

| JEPI | JPMorgan Equity Premium Income ETF | 97.85 |

| ABBV | AbbVie Inc | 132.60 |

| Total | 1,695.54 |

Youtube channel – Our Journey to Financial Independence

Here’s the video version of our Dividend Income breakdown. Scroll down to keep reading. By the way, feel free to visit our Youtube channel.

2021 Retire Early Dividend Income Summary

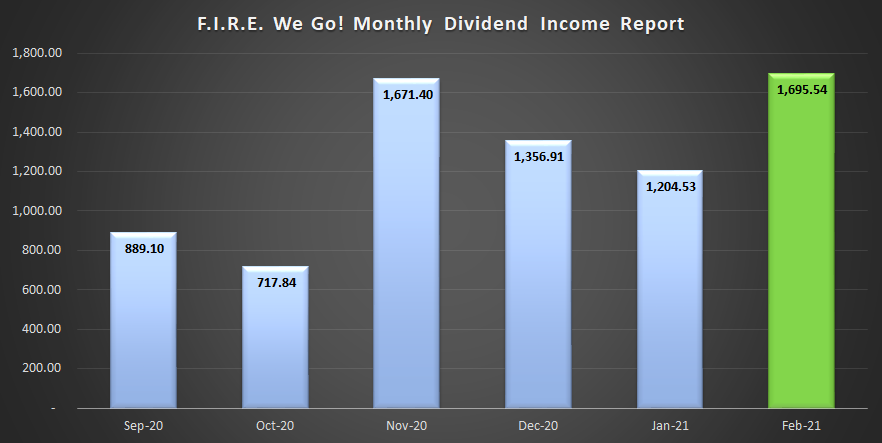

We are +1.44% since last quarter (Nov 2020). As you can see from the graphic, this is the quarter we receive the higher dividend payments, especially because of the financial sector institutions.

Year to date, we’ve received $2.900,07. Our goal is to become financially independent in 2028, receiving $40,000 per year in dividends. As a result, January and February represent 7.25% of our goal. Still, a lot to grow, and we’re happy with our journey to Financial Independence.

Our Passive Income Strategy

Let’s examine some of the moves we’ve made with our portfolio:

- Bank of Montreal [BMO.TO]: We increased our position by 50 shares. This move represents a 23% increase in dividends received, compared to last quarter;

- Emera [EMA.TO]: We also increased our position by 50 shares, representing a 15% increase in dividends received compared to the last quarter;

- Toronto Dominion Bank [TD.TO]: We had a lot of exposure to TD and decided to sell 100 shares for a profit. The capital gains were used to increase our exposure to the global markets, with VIU.TO. We now own 700 shares, and won’t be increasing this position;

- Royal Bank of Canada [RY.TO]: No changes since last quarter. We’re planning to increase our RY position this year (we own 211 shares);

- Vanguard FTSE Canadian Capped REIT Index ETF [VRE.TO]: We increased our position by 18 shares and now own 27 shares;

- Abbvie Inc [ABBV]: One of the industries we invest in the U.S. is healthcare. We are happy with our Abbvie position. Actually, ABBV is part of our RRSP allocation. We DRIP Abbvie, and every quarter, we get one more share;

- AT&T [T]: Similar to Abbvie, inside our RRSP allocation, and every quarter, we drip four shares.

Asset Allocation – Financial Independence Journey

The above graphic represents the dividends received based on our asset allocation. The higher percentage of Canadian dividends is a reflection of the financial sector. Our goal remains the same, increase U.S. and international exposure.

Thanks for letting us be part of your day and journey. Stay safe!

Comments on this entry are closed.

Impressive February Income guys ! Good job! ??? Great content !

Thank you 🙂