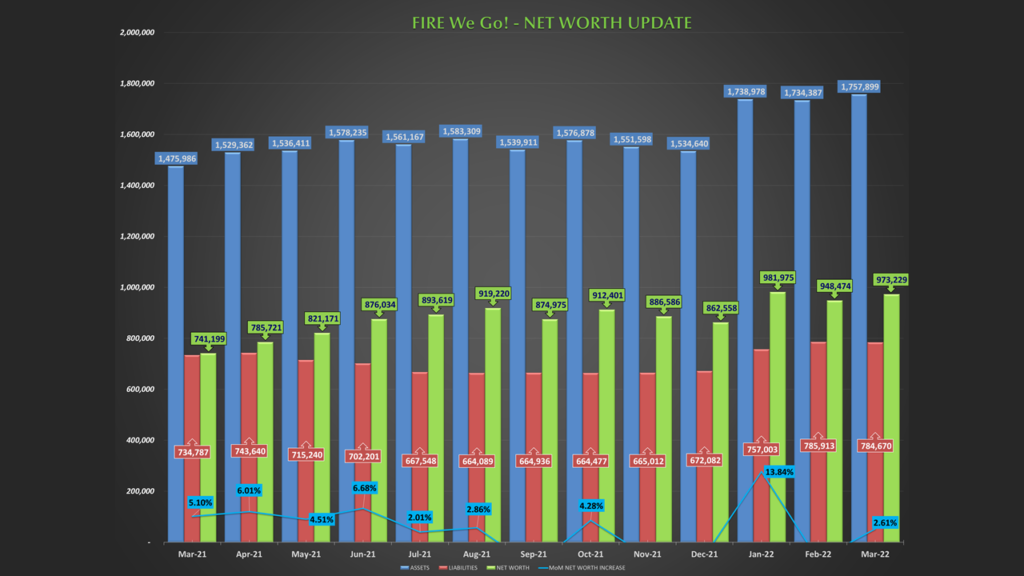

We will become Financially Independent in 2024, and in order to do that, we track not only our spending but our net worth. We want to share our progress with you. Let’s take a look and see how we ended in March 2022.

What is Net Worth and why is it important?

Here’s an excerpt from Wikipedia:

For individuals, net worth or wealth refers to an individual’s net economic position, the value of the individual’s assets minus liabilities. Examples of assets that an individual would factor into their net worth include retirement accounts, other investments, home(s), and vehicles. Liabilities include both secured debt (such as a home mortgage) and unsecured debt (such as consumer debt or personal loans). Typically intangible assets such as educational degrees are not factored into net worth, even though such assets positively contribute to one’s overall financial position.

Net Worth Calculation Breakdown – Mar 2022

Assets: 1,757,899

| Principal residence | 1,030,000 |

| Condo overseas | 137,500 |

| Pension | 34,054 |

| Investments (RRSP, TFSA, Spousal RRSP, Margin Account) | 275,299 |

| Smith Manoeuvre | 281,046 |

Liabilities: 784,670

| Principal residence | 770,736 |

| Condo overseas | 0,000 |

| Car | 13,934 |

Net Worth: 973,229

Financial Independence Summary

Let’s take a look at a few indicators:

- Our Net Worth has increased 2.61% over February 2022

- Our assets are down since the beginning of 2022. We increased our assets using additional equity from our home in January 2022. The world events explain why they went down

- Liabilities increased as well for the same reason as the above

- Overall, the Net Worth increased 31.30% YoY

- On average, since we started tracking the Net Worth back in July 2022, we are increasing by 2.38%

We have received quite a lot from the Financial Independence Community and we would like to give it back. The same Net Worth Update that we present on YouTube and also the graphics on this page is available for free. All that you have to do is to click on this link and download it.

Our strategy for financial independence remains the same: keep investing in international real estate, dividend-paying stocks and ETFs.

Where do we invest to achieve Financial Independence?

Principal Residence

Currently, we are living in Toronto, a rather expensive city! But that high cost of living also means that our house has appreciated over the past few years quite a bit. Our home was purchased in 2016 for $615,000 but was recently valued in 2020 at $860,000 2022 at $1,030,000.

Condo overseas

In 2019 we bought a condo in Brazil as an investment property. This price was paid in Reais (Brazil’s currency) but we have converted this to Canadian dollars to keep things simple.

Pension

Kristine works for the municipal government and we are using the same number every month based on her best five years.

Investments

This is the total of our investments in both of our RRSPs and TFSA’s, our margin accounts, and Gean’s investments overseas. We are 100% invested in equities (dividend and growth stocks) and ETFs.

Smith Manoeuvre

Since renewing our mortgage in 2020, we are using the HELOC (Home Equity Line of Credit) to invest in dividend-paying stocks (100% Canadian stocks).

Thanks for letting us be part of your journey

We recognize that personal finance is different, and as always, there are lots of factors to take into consideration. We are not impressed by these numbers, they’re just a metric used to make sure we’re on the right track to financial freedom.

Remember: back in 2019, we had over 60,000 dollars in debt, and now, slowly growing our portfolio and preparing ourselves. Lots of learning opportunities ahead, and most importantly, enjoying the journey. You can do it, too!

Recommended links to help your Financial Independence Journey

- Start your Journey to Financial Independence by opening an account with Wealthsimple trade

- Financial Independence Books we’ve read and helped us

When available, we use referral links, which means if you click one of the links in this video or description and make a purchase we may receive a small commission or other compensation.

Thanks for letting us be part of your day and journey. Stay safe!